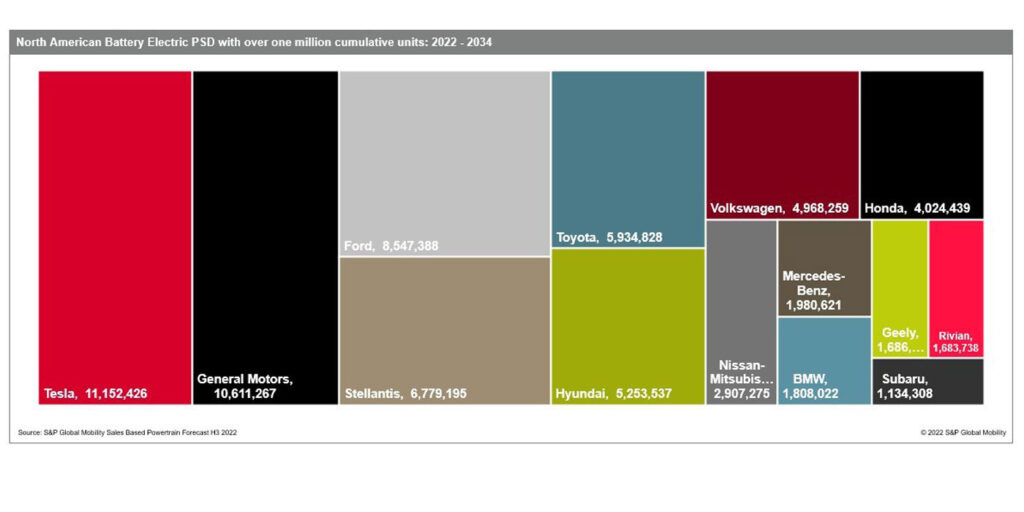

Although U.S. electric vehicle registrations remain dominated by Tesla, the brand is showing the expected signs of shedding market share as more entrants arrive. Much of Tesla’s share loss is to EVs available in a more accessible MSRP range – below $50,000, where Tesla has trouble competing.

Regardless of brand or price point, early S&P Global Mobility data suggests consumers moving to electric vehicles in 2022 are largely doing so from Toyota and Honda. Both Japanese companies built a U.S. legacy via fuel economy and powertrain technologies – including electrification through hybrids, plug-in hybrids and fuel-cell electric vehicles. S&P Global Mobility conquest data for Tesla’s Model 3 and Y, Ford Mustang Mach-E, Hyundai Ioniq5, and Chevrolet Bolt show strong captures of buyers from the two leading Japanese brands.

So far, most EVs continue to be acquired for higher MSRPs and by buyers with higher incomes than the demographic profile for total light-vehicle registrations, in part because most EVs in the U.S. are Teslas.

Tesla’s position is changing as new, more affordable options arrive. Given that consumer choice and consumer interest in EVs are growing, Tesla’s ability to retain a dominant market share will be challenged going forward.

S&P Global Mobility predicts the number of battery-electric nameplates will grow from 48 at present to 159 by the end of 2025, at a pace faster than Tesla will be able to add factories. Tesla’s CEO Elon Musk confirmed (again) during a recent earnings call that the company is working on a vehicle priced lower than the Model 3, though market launch timing is unclear.

Tesla’s model range is expected to grow to include Cybertruck in 2023 and eventually a Roadster, but largely the Tesla model lineup in 2025 will be the same models it offers today.

Tesla has opened two new assembly plants in 2022 and is looking for the site of its next North American plant. Tesla today is the brand best equipped for taking advantage of the immediate surge in EV demand, though manufacturing investments from other automakers will erode this advantage sooner than later.

Throughout 2022, EVs have gained market share and consumer attention. In an environment where vehicle sales are limited by inventory and availability, EVs have gained 2.4 points of market share year over year in registration data compiled through September – reaching 5.2% of all light vehicle registrations – according to S&P Global Mobility data.

New EVs from Hyundai, Kia and Volkswagen have joined Ford‘s Mustang Mach-E, Chevrolet Bolt (EV and EUV) and Nissan Leaf in the mainstream brand space. Meanwhile, luxury EVs from Mercedes-Benz, BMW, Audi, Polestar, Lucid, and Rivian – as well as big-ticket items like the Ford F-150 Lightning, GMC Hummer, and Chevrolet Silverado EV – will plague Tesla at the high end of the market.

With the Model Y and Model 3 combined taking 56% of EV registrations, the other 46 vehicles are competing for scraps until EVs cross the chasm into mainstream appeal.

But consumer willingness to evolve to electrification remains the largest wildcard. Looking past Model Y and Model 3, no single model has achieved registrations above 30,000 units through the first three quarters of 2022. The second-best-selling EV brand in the US is Ford. However, Mach-E registrations of about 27,800 units are about 8% of the volume Tesla has captured, according to S&P Global Mobility data.

Tesla has four of the top five EV models by registration; in the sixth through 10th positions are the Chevrolet Bolt and Bolt EUV, Hyundai Ioniq5, Kia EV6, Volkswagen ID.4 and Nissan Leaf. Through September, the Bolt has seen about 21,600 vehicles registered, Hyundai and Kia are in the 17,000-18,000-unit range, and VW approached 11,000 units. Including the tenth-place Leaf, no other EV has had registrations above 10,000 units over the first nine months of 2022.

An existing pool of current EV owners who also have pickups can be a benefit for the efforts in the full-size EV pick-up space, particularly for the Ford F-150 Lightning, Chevrolet Silverado EV and GMC Sierra EV, each of which is aimed at a traditional pick-up use case and owner. The Rivian S1T, GMC Hummer EV and Tesla Cybertruck each occupy a lifestyle pickup space, geared toward innovator buyers and statement-makers, and could be more likely to conquest buyers to the pickup segment as well as to an EV purchase. But for now, electric vehicles remain the provenance of sedans and small SUVs.