According to a recent IDTechEx report, the success of electric vehicles in the construction industry will largely be determined by battery prices being low enough that the total cost of ownership is cheaper than diesel alternatives. IDTechEx’s report, “Electric Vehicles in Construction 2023-2043“, shows that there is a battery price tipping point, under which it will be cheaper over the vehicle lifetime to operate an EV.

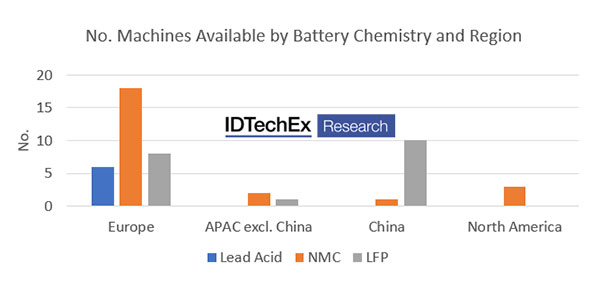

The report also showed that with Europe and China being more established markets for electric construction vehicles, conclusions about battery chemistry trends from OEMs in these regions can be made. What is obvious at this early stage is that Europe heavily favors NMC, while China has chosen LFP.

Battery requirements in construction vehicles

According to the report, IDTechEx found that the priorities for a battery are huge range capacities at low costs. With some of these machines being gargantuan, and usually requiring concrete counterbalances to handle the massive loads they encounter, battery weight isn’t so much of an issue. Power density is also not much of a priority. Unlike electric cars, construction vehicles do not tend to have large spikes in power demand and are more likely to operate at a steady rate for a long time.

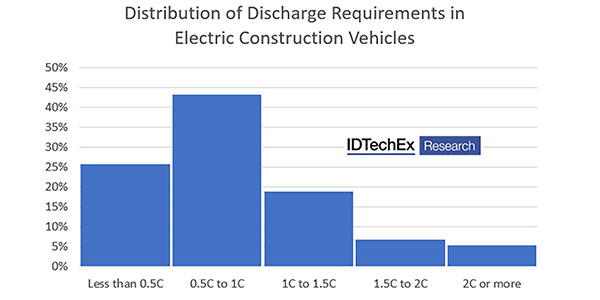

The XCMG XE270E is a 27-tonne excavator leviathan with a battery capacity of 525kWh, but its motor is a measly 140kW. In fact, research in IDTechEx’s report shows that the vast majority of electric construction vehicles have a peak discharge requirement of less than 1C, with one quarter of vehicles requiring less than 0.25C peak discharge.

Both NMC and LFP offer the required performance for construction, happily coping with the peak discharging requirements and having high enough volumetric and gravimetric densities to fit in the machines. Speaking broadly, IDTechEx said NMC tends to be a higher-performance battery than LFP, with better energy and power densities but coming at a premium. It would make sense then for the industry to select LFP.

Why is NMC dominant in Europe and LFP in China?

Most of the electric construction development so far has used battery pack suppliers, such as Northvolt, Forsee and Volta, and most of their products use NMC. IDTechEx’s research finds that over 75% of the offerings from European and North American pack manufacturers use NMC. These companies have been supplying a range of industries, including heavy-duty road vehicles like buses and trucks. IDTechEx speculates that this is why Europe has been mostly choosing NMC so far, but with battery pricing being a key factor in the success of electric construction vehicles, it is likely that there will be increased LFP uptake in the future.

Sodium ion, a future candidate?

In IDTechEx’s report, a 10-year CAGR of 37% is forecasted, with the electric construction machine industry growing to a value of US$150 billion in 2043. All of this growth is going to give rise to a significant battery demand, and whether it be NMC, LFP, or perhaps even Na-ion, the evolution of this industry is going to be quick.