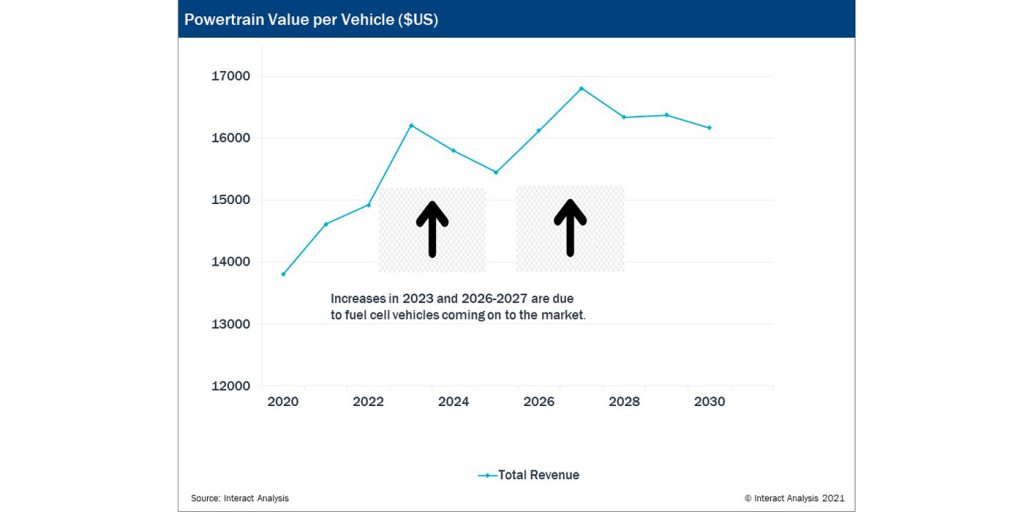

According to a recent report by Interact Analysis, in 2020, the average value of the electric truck and bus powertrain components in a single vehicle was estimated at $13,803, with the battery being over half of this.

The good news for suppliers, the company says, is that this is projected to increase to $16,204 by 2023.

The three main reasons for the increase are:

- The underlying mix of vehicles will trend more towards larger vehicles over time with a smaller percentage of smaller, light-duty trucks and more medium- and heavy-duty trucks for example.

- In 2020 and 2021, there is a strong share of hybrids (often mild hybrids), but BEVs are forecast to grow faster.

- In 2023, Interact Analysis projects that Nikola will be able to bring fuel-cell vehicles to the market in volume. Although the number of vehicles will be small, the high value of the fuel-cell system means that even a small number of vehicles can affect the average powertrain value.

The further increase in average value per powertrain in 2026 and 2027 is also partly because fuel-cell vehicles will be reaching maturity in these years and adding significant volume to the market, the report states. Therefore, Interact Analysis says, even as the price for a given product for a given vehicle is forecasted to decrease rapidly due to tough price erosion, the changes in the underlying mix of powertrains and vehicle types will continue to offer strong business for vendors. A typical BEV powertrain for a bus or medium-/heavy-duty truck can be as much as $100,000 at the moment. With stable average pricing and rapidly increasing units, strong revenue growth is forecasted.

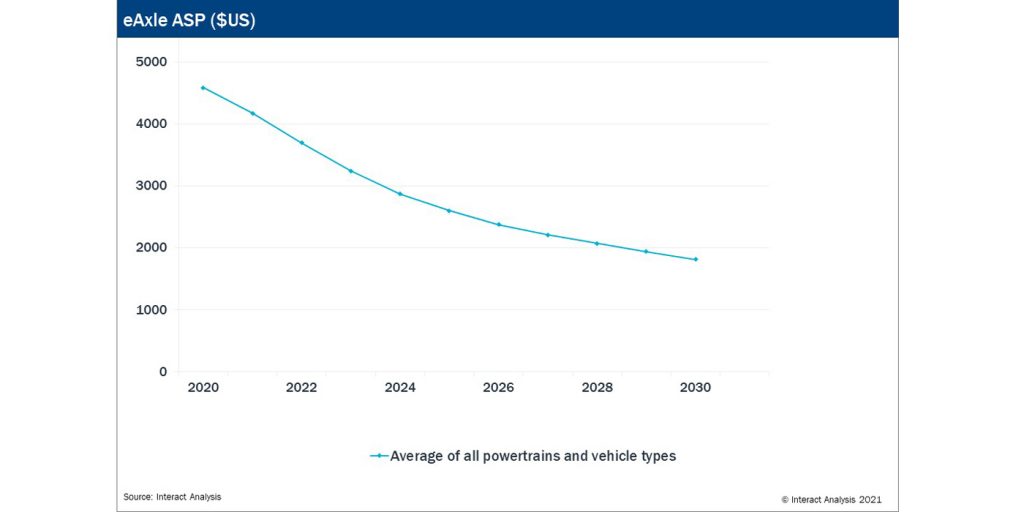

While some components are able to maintain pricing due to the underlying vehicle mix, this is not the case for every component.

eAxles to gain traction

Different definitions of eAxle exist in the industry. For this report, Interact Analysis defined an eAxle to be a single unit consisting of a motor and transmission and sometimes other components. In an eAxle, the motor is located on or very near the axle, connected to it. All light-duty transverse architectures were counted as eAxles. Interact Analysis believes that the adoption of eAxles is more a question of when than if.

As products are developed, new architectures are built specifically for EVs (rather than using conventional vehicle layouts from combustion-engine vehicles) and economies of scale are achieved, eAxles will become very competitive in cost with discrete motors and transmissions as well as offering space savings and design freedom. However, many OEMs are still focused on central-drive solutions on existing vehicle design architectures and some of them have no immediate plan to transition to eAxles, Interact Analysis forecasts that eAxles will not fully take over until the 2030s.

eAxles are already common in buses (including the ZF portal axle) and light-duty trucks. ZF and Meritor are among the leading suppliers, the report states. In heavy-duty trucks, the market is just getting started, but many companies throughout the supply chain are committed to an eAxle strategy over the coming years.

Unlike the trends in batteries and some other components, the average eAxle price will decline quite significantly both in specific cases and averaged across all powertrains, regions and vehicle types. This is because over time many suppliers will be capable of producing the product, and greater efficiencies will be achieved once research and development is completed and economies of scale are achieved. Particularly strong competition is forecast in the first half of the decade. Overall, price erosion is forecast to be higher than for most of the other components included in this report.

The full report from Interact Analysis can be viewed here.