Today, more than 1.6 million electric vehicle drivers are on U.S. roads; this is expected to grow to 10-35 million by 2030. Significant improvements in technology, along with a growing sense of legislative and social urgency in the push toward clean transportation, are changing how cities, institutions and businesses think about their roles in the transportation economy. These trends are now opening the door for EV charging companies to scale and significantly impact.

According to a U.S. auto market analysis by Cox Automotive and Kelley Blue Book, the sales growth of 81% from both electric and hybrid vehicles outpaced overall market performance in the first quarter of 2021. By 2030, studies indicate that as many as one-third of all cars on the road will be electric. At this rate, it’s likely your kids, and especially your grandkids, will one day drive an EV. In 2040, don’t be surprised if you pull up to a red light and see that more than half of the vehicles around you are fueled by electricity.

The policy tailwind

On April 22, the Biden administration held a virtual climate summit with world leaders, urging them to be decisive and take action to harvest the booming clean energy benefits ahead. Several countries are responding with pegging their new zero-emissions targets 45-50%. In the U.S., to see decarbonization become a reality, Washington State and California have banned the sales of gas-powered vehicles as of 2030 and 2035, respectively.

Under the $2 trillion infrastructure bill, the Biden Administration is committed to building 500,000 new and equitable EV charging stations across the U.S. – four times the number of gas stations the country currently has. This mandate simultaneously calls for the amplification of new infrastructure and charging infrastructure in urban centers and rural areas.

Other changes in favor of the transportation electrification movement include the Environmental Protection Agency (EPA) announcing stricter emissions rules, which is expected sometime this summer. Also, as of April 2021, 17 states, including the District of Columbia and Puerto Rico, have committed to new executive orders for 100% renewable energy for their power sector and/or the whole economy in order to achieve zero GHG emissions. Even still, the electrification of transportation support at state and federal levels have barely scratched the surface, and it will only increase as smart cities lead the way into a forward-thinking electrified future.

The investment tailwind

As automakers pour $2 billion into new electric vehicle models, a growing amount of funds is rising to ease the costs for businesses and individuals looking to install charging stations. The U.S. Department of Energy has announced a decision to invest $162 million to reduce carbon emissions, electrify freight trucking, and expand electric vehicle charging infrastructure. Announced investments—New York’s $701 million and California’s $430 million—are examples of state-level initiatives in electric vehicle charging that will change the horizon for businesses, multifamily buildings, municipalities, retail centers and the end-customer—EV drivers.

The fabric of a smart EV ecosystem includes collecting pieces and moving parts that depend upon one another for efficacy. If the whole is indeed greater than the sum of its parts, key players within this vastly changing and developing ecosystem – original equipment manufacturers, utilities, city and national leaders, consumers and businesses—are quickly coming to this realization with EV charging today. To move forward, industry competitors must cooperate. And with perpetual innovation, a new environmentally conscious and green EV charging landscape can begin to flourish within our cities.

Market tailwinds

Finally, heads continue to turn as the national and global financial markets place large bets on transportation electrification. As early as 2018, the North American EV charging infrastructure market was predicted to boom to $18.6 billion by 2030—globally up to $40 billion, with an estimated 40 million charging points projected to be deployed worldwide. Tesla, which generated $1.4 billion in sales in the first quarter of 2021, is more valuable than the top eight largest automakers combined. While GM invests $20 billion to deliver 20 new EV models to the U.S. market by 2023—a record of 100 new electric vehicle models are set to be introduced by 2024 by 17 auto companies. Dozens of new electric vehicles have entered manufacturing lines, and investors are looking beyond the electric car. EV and EV charging technology are excelling rapidly, and the market is responding accordingly.

Charging forward

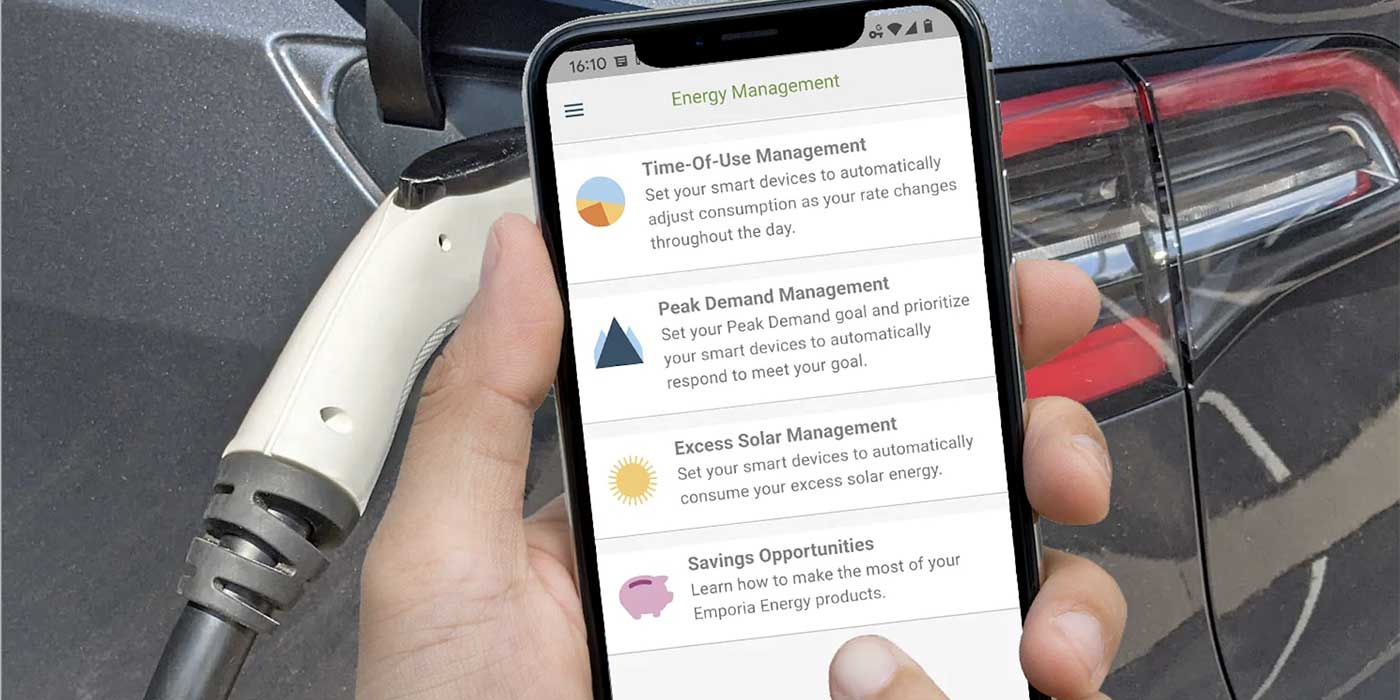

Together, these tailwinds have the potential to power a bright future for EV charging. As momentum toward transportation electrification continues to accelerate, businesses must understand and anticipate the needs of EV adoption on a timeline beyond the charging station installation event. Particularly in places like California, EV charging will transition from “attractive amenity” to “critical infrastructure” for city leaders, employers, landlords and retailers across the state. With the prospect of an untold number of innovative new business models, site owners can look forward to the financial benefits of EV charging. As we move from millions of transactions per year to orders of magnitudes more, the economic potential around EV charging will be massive. EV charging, however, will also be under pressure to deal with exponentially more complexity in an ever more streamlined way.

The next several years are pivotal to building a manageable and profitable EV charging infrastructure that is robust enough to handle the additional volume, energy demand and the inevitable midstream interventions from changing regulations. Now is the time to add the infrastructure necessary to meet the growing demand for electric vehicles. As the entire planet races to catch up with EV innovation and expansion speed, the businesses that don’t keep pace will be left behind.

Jordan Ramer is the CEO and founder of EV Connect, a provider of EV charging solutions for commercial, enterprise, hospitality, healthcare, educational and government facilities.