Supporters of vehicle electrification point to the more than 140,000 EV charging stations currently deployed across the United States – including Level 2 AC and Level 3 DC fast chargers and both public and restricted access units – as a sign that a budding system to support our transportation transformation is in place.

However, S&P Global Mobility data shows that the charging infrastructure is not nearly robust enough to fully support a maturing electric vehicle market.

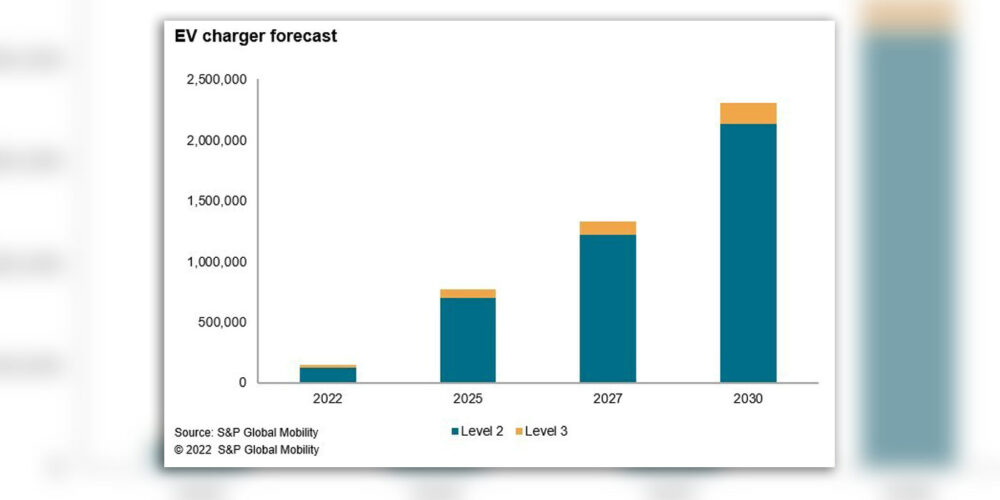

Even when home-charging is taken into account, to properly match forecasted sales demand, the United States will need to see the number of EV chargers quadruple between 2022 and 2025, and grow more than eight-fold by 2030, according to S&P Global Mobility forecasts.

S&P Global Mobility estimates there are about 126,500 Level 2 and 20,431 Level 3 charging stations in the United States today, plus another 16,822 Tesla Superchargers and Tesla destination chargers. The number of chargers has grown more in 2022 than in the preceding three years combined, with about 54,000 Level 2 and 10,000 Level 3 chargers added during 2022.

S&P Global Mobility registration data shows that there are 1.9 million electric vehicles (EVs) in operation today, or 0.7% of the 281 million vehicles in operation, as of Oct. 31, 2022. New light-vehicle registration share for EVs reached 5.2% over the first 10 months of 2022. EV market share for new vehicles is likely to reach 40% by 2030, according to S&P Global Mobility forecasts, at which point the total number of EVs in operation could reach 28.3 million units.

To support that vehicle population, S&P Global Mobility analysts say they expect there will need to be about 700,000 Level 2 and 70,000 Level 3 chargers deployed, including both public and restricted-use facilities. By 2027, the analysts expect there will be a need for about 1.2 million Level 2 chargers and 109,000 Level 3 chargers deployed nationally. Looking further to 2030, with the assumption of 28.3 million EVs on U.S. roads, an estimated total of 2.13 million Level 2 and 172,000 Level 3 public chargers will be required – all in addition to the units that consumers put in their own garages.

S&P Global Mobility suggests demand across the United States will develop in a lopsided manner, especially in states where EV adoption is already comparatively strong. Currently, 35 states have signed on for federal assistance under the Bipartisan Infrastructure Law, of which $7.5 billion is earmarked for EV charging infrastructure. President Biden has pledged that the government will fund the installation of 500,000 charging stations – but that is just a starting point.

The four U.S. states with the highest number of vehicles in operation and highest new-vehicle registrations traditionally are California, Florida, Texas and New York. California, which embraced EVs early, is the state pushing for the most significant emissions restrictions. As such, it is the largest EV market, with about 36.9% of total EVs in operation and 35.8% of total U.S. light-vehicle EV registrations from January through September 2022.

Florida is in second place, but with only 7.4% of light-vehicle EV registrations and 6.9% of EV VIO. Texas is not significantly further behind Florida, with 5.8% of VIO and 6.4% of EV state-level light-vehicle registrations.

However, neither Florida nor Texas have participated significantly in the emissions discussion nor followed California’s lead like the “CARB states” mostly in the northeastern and northwestern United States. As a result, the size of these markets – rather than adoption rates – is the main reason Florida and Texas rank highly in EV share of new vehicle registrations and VIO. These are also states which have weather largely favorable to EV operation.

Texas currently has about 5,600 Level 2 non-Tesla and 900 Level 3 chargers, but by 2027 S&P Global Mobility forecasts that the state will need about 87,500 Level 2 and 7,800 level 3 chargers to support an expected the expected 1.1 million EV VIO at that time. Meanwhile, Florida currently has about 5,600 Level 2 non-Tesla chargers and 955 Level 3 chargers, but is expected to have 1.06 million EV VIO potential in 2027. To support these vehicles, S&P Global Mobility forecasts that Florida will need to grow its charging infrastructure to about 77,000 Level 2 and 6,800 Level 3 charging stations.

Currently, 85% of Level 3 chargers are in U.S. Metropolitan Statistical Areas (MSAs as defined by the U.S. Census Bureau, and including 384 metro areas); 89% of Level 2 chargers are in these areas. For Tesla owners, 82% of its Superchargers and 83% of its destination chargers are in MSAs.

There also are evolving solutions capable of changing the EV charging station model. Battery swapping, wireless charging, and increased deployment of DC wallbox solutions at home are three solutions which still can change the landscape. In China, the practice of battery swapping is growing and has had some success, though it has seen virtually no application in Europe beyond the first NIO stations in Norway, and not yet really tested (nor expected) in the U.S. market.