Charging speeds for electric vehicles vary, from as little as 15 minutes using an ultra-rapid 350 kW charger, to as much as 24 hours when relying on a domestic wall outlet. OEMs are working on extending the charging rate up to 3 C (or even beyond), such as by using optimized cell cooling to allow higher power charging for the car battery at fast chargers.

The C-rate tells us how the charging power relates to the battery pack capacity. 1 C is defined as the power that would, over an hour, deliver the complete capacity of a battery. For a 60 kWh battery, 1 C is 60 kW, 2C is 120 kW, and 0.1 C is 6 kW. The speed of public charging is increasing all the time. Eventually, we could reach a point where recharging barely takes longer than filling up with fuel.

High power chargers offer the fastest charging rates

In its latest study, IDTechEx forecasts that most of the new DC charging installations will be in the 100+ kW power classes. IDTechEx estimates that by 2032, these will double and take up roughly 44% of the market share, exhibiting a CAGR of roughly 42% from 2022 to 2032. The average charging power of EVs will also rise as battery chemistries are enhanced, a shift to wide bandgap semiconductors is made and improved thermal management strategies are adopted.

Ultra-rapid chargers deliver power at 100 kW or more, typically at 100 kW, 250 kW, 270 kW, or 350 kW. These represent the future of EV charging, though the fastest technology is currently limited to the most expensive electric cars, such as the Porsche Taycan, Audi e-Tron GT, BMW iX, and Lucid Air. The new IDTechEx report “Charging Infrastructure for Electric Vehicles and Fleets 2022-2032” contains benchmarking of various high power charging units by power, voltage, and current levels.

Recently, a Rimac Nevera, a Croatian electric supercar, visited an Ionity fast charging station and showed average charging speeds of over 260 kW. The Nevera’s 120 kWh, liquid-cooled battery uses an 800 V architecture which should be able to recharge from 0 to 80% SoC in 22 minutes, with the car supporting a peak charging power of 500 kW. The Nevera achieved the highest charging power available for any production EV and was limited by Ionity’s Tritium charging unit which is only capable of 350 kW.

What does a fast-charging curve tell us?

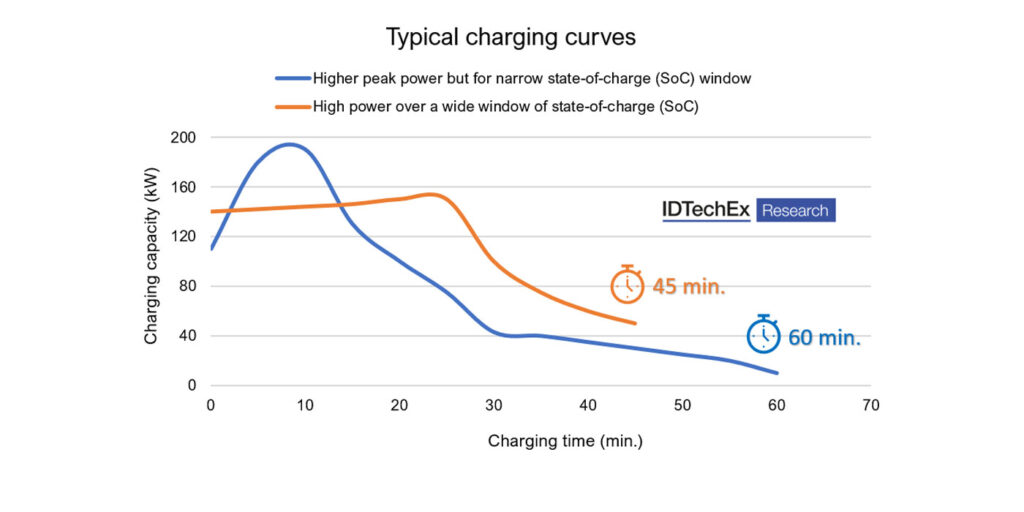

Charging curves are not a straight line. As soon as you plug in, power jumps to the maximum acceptable charging rate of the EV if the battery has been pre-conditioned. In other instances, it might ramp up to peak power steadily. It then begins a (linear or step) drop-down to 100% SoC with the charging power dropping significantly after 80% SoC. Charging at peak power is only done for a short while before components get too hot and the cooling needs to kick in. Battery degradation also becomes apparent when charging quickly above 80% SoC. Auto OEMs adopt different charging strategies by limiting peak power — if the initial charge rate is limited, the charging power delivered can remain constant till 80% SoC. This is more ideal as the car charges at lower average power, but is more time efficient.

This is what Audi demonstrated with its e-tron 55, wherein peak charging power was limited to just under 150 kW. The e-tron’s charging curve is flat up until about 75% SoC, adding more range in a shorter time while other competitors quoted high peak charging rates that are only achieved for the first few minutes of charging. The key takeaway is that a flatter charging profile is better than a high-peak profile that drops significantly over time. In other words, the charging speed is proportional to the field below the curve (which represents energy) over a typical charging session.

So auto OEMs are controlling the power their EVs can accept via their own battery management systems (BMS) but on the charging operator side, there also exists other limitations to installing the high power chargers (HPCs). One could make the argument that installing high power chargers everywhere is an ideal solution since they can throttle their power and voltage levels down to suit most mass-market EV models, but this is not the case in reality. IDTechEx research has found that grid related constraints, high hardware, and installation costs, and limited interoperability are the biggest hurdles to widespread HPC deployment.

The various chargepoint operators and their highest power offerings, supply chain and business models are all covered in the IDTechEx report. A comparison between different hardware suppliers can provide clarity to Auto OEMs and fleet operators looking to establish partnerships and deploy their own network of supporting infrastructure to boost EV sales.

Charging without a grid connection – the launch of Infrastructure-as-a-service

Since Level 2 and DC fast charging (DCFC) stations consume large amounts of power, the grid (including transformers, substations, and eventually transmission lines) will need to be upgraded. This is particularly expensive for DCFC, which can draw the equivalent of a whole neighborhood’s electricity needs at once.

Integrated battery storage-based fast charging stations are being rolled out that require no civil engineering work or adjustments to the grid connection. The time and costs required for installation are minimal compared to similar HPC offerings. These stations work on the principle that by coupling the charging station with a buffer battery, it will be possible to install fast-charging columns almost everywhere. The solution is therefore ideal for opening new locations quickly and cost-effectively. Simply transport the unit to the site, plug it in and you’re done.

Partnerships like Volkswagen-E.ON, Jolt-AECOM and FEV-Uniper are involved in deploying such integrated battery-based charging units offering up to 150 kW of charging power per unit on average. Their operation is seen in urban centers and areas where a high footfall of EV drivers is expected. These projects have shown the viability of a new business model — Infrastructure as a service (IaaS) which is characterized by low capex, flexibility in location, and fast expansion.