The automotive sector continues to face a winding road amid inflation and ongoing supply challenges. Deloitte’s recent report, “2023 Global Automotive Consumer Study,” explores a variety of concerns shaping the global automotive sector, including consumer interest in EV adoption, vehicle purchase intent, connectivity, and consumer trust. The report is based on a survey of more than 26,000 consumers from 24 countries conducted between September and October 2022.

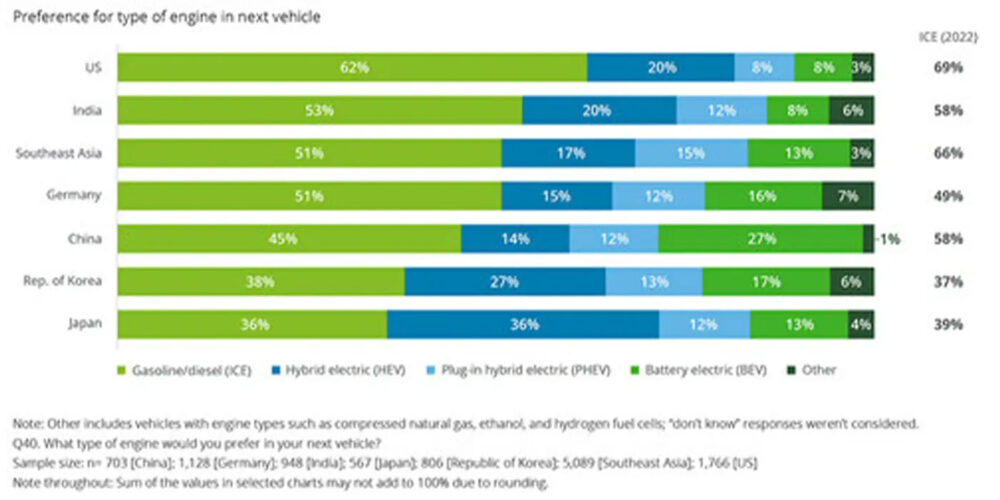

While internal combustion engine (ICE) vehicles still dominate future vehicle purchase intentions, preference for electrified powertrains continues to rise. Overall, the global shift to EVs is occurring at different speeds as individual markets face varying challenges to adoption, including cost and availability of charging infrastructures.

- In the U.S., intent to purchase hybrid electric vehicles (HEV), plug-in hybrid electric vehicles (PHEV) and all-battery powered electric vehicles (BEV) are each up by 3 percentage points from 2022. Globally, consumer interest in battery electric vehicles (BEVs) is highest in China (27%, up 10 points year-over-year). Japanese consumers continue to show the highest preference toward hybrid electric vehicles (HEV/PHEV) (48%, flat from 2022).

- Spurred by inflation, cost is the top concern hindering EV adoption in the U.S. (52%) and Japan (50%). Driving range (Germany, 57%); time required to charge (Japan, 50% and Republic of Korea, 49%); the lack of public charging infrastructure (Southeast Asia, 54% and India, 43%); and battery safety (China, 32%) are also top of mind.

- Despite mounting concerns about climate change and reducing emissions, lower fuel expenses are the top reason consumers choose EVs in the U.S., Germany, India, Japan, the Republic of Korea and Southeast Asia, in an effort to reduce vehicle operating costs.

- The majority of EV drivers expect to charge their vehicles at home, particularly in the U.S. (77%), Germany (75%), Japan (72%) and China (65%). Demand for public charging is highest in the Republic of Korea (43%) and India (41%).

- Among those planning to charge their vehicles at home, half of U.S. consumers (51%) will leverage traditional power grids, compared to 66% who said the same in 2022, demonstrating an increased desire to use renewable power for EVs.

- Simple payment options for public charging may help drive overall adoption: Most drivers globally would prefer to use a credit/debit card (Republic of Korea at 57%, U.S. at 56%, Japan at 51%, and Germany at 47%) or smartphone app (China at 53%, Southeast Asia at 52%, and India at 45%).

- Consumers in most markets, including 50% of U.S. consumers, are willing to spend between 20 minutes to one hour charging a vehicle at a public charging station from empty to 80%. To pass the time, U.S. consumers would most prefer to have amenities like Wi-Fi connectivity (64%), restrooms (60%) and beverages (56%) readily available.

The COVID-19 pandemic created significant supply challenges for the automotive industry which continue to impact the vehicle purchasing process. Now, despite consumers being more accepting of longer vehicle delivery wait times, quality and price continue to factor into purchase decisions.

- Product quality tops the list of factors for consumers around the globe when choosing a brand for their next vehicle, including in the U.S. (61%) and even more so in Southeast Asia (71%). Only in Japan are vehicle features (50%) the top consideration for a purchase decision.

- More than 80% of U.S. consumers who acquired their current vehicle new intend to buy a new vehicle again, while only 17% of people who acquired their current vehicle used said the same.

- The current inventory crisis may be training consumers to expect longer wait times for delivery of a new vehicle: 55% of consumers in India and nearly half (48%) of consumers in the U.S., China and Southeast Asia note that 3-12 weeks is an acceptable wait time for a new vehicle.

- Despite shifting consumer behaviors, some things never change: Before committing to a vehicle purchase, U.S. consumers want a good deal (57%) with transparent pricing (45%) and physical interaction with the vehicle (42%).

- Three-quarters (75%) of consumers in the U.S. expect to pay less than $50K for their next vehicle.

- As OEMs consider offerings to drive profits, including bringing insurance products in-house, 36% of U.S. consumers are interested in purchasing insurance directly from the vehicle manufacturer. This is even higher in India (82%), China (76%) and Southeast Asia (71%), signaling a significant disruption for the traditional value chain.

“Despite the challenges of the past several years, the automotive industry continues to adapt and charge forward,” said Karen Bowman, vice chair and U.S. automotive leader, Deloitte LLP. “Although historically high transaction prices are a significant challenge for consumers, a strong desire to reduce refueling costs is driving EV purchase intent around the world. For their part, industry players are looking to capitalize on the shift to EVs to unlock new revenue streams in the form of value-added services that enhance the mobility experience. Ultimately, automakers that are able to drive more of the mobility value chain can be well positioned to thrive in rapidly evolving global market conditions,” Bowan continued.

Consumers across markets trust the dealer where they originally acquired or normally service their vehicle most, signaling the important role dealers play in building and maintaining customer relationships.

- U.S. consumers most trust the dealership where they normally service (31%) or acquired their vehicle (28%), and the manufacturer (27%), underscoring the importance each has in building loyalty.

- While consumers in India (77%), Japan (74%) and China (73%) prefer to service their vehicles at the dealership, in the U.S., aftermarket providers claim a significant share of the vehicle service market (38%) due, primarily, to a perception of lower cost (34%).

- Surveyed consumers in India (84%) and Southeast Asia (81%) see greater benefits in connected features to provide maintenance updates and vehicle health reporting, compared to those in the U.S. (60%) and Germany (56%).

- When managing data generated by the vehicle, U.S. consumers trust OEMs the most (15%). Though, 30% percent don’t trust anyone — including dealers or technology service providers. However, U.S. consumers say they are ready to share personally identifiable information (PII) if it will help them get maintenance updates (60%), traffic updates (58%), and updates to improve road safety (57%).

- Most U.S. consumers would rather pay for connected vehicle technology services upfront as part of the vehicle purchase price (46%) or on a per-use basis (33%), rather than via subscription (20%).

“Connected vehicles can enhance the mobility experience, but unfortunately, many consumers are hesitant to trust their data with anyone in order to make this happen. That said, both the dealer and brand are equally important and trusted when it comes to vehicle purchasing and servicing. Those who leverage key building blocks of trust such as transparency and empowerment to foster loyalty may prove successful in unlocking a critical advantage in an increasingly competitive global market,” said Jody Stidham, U.S. automotive managing director, Deloitte Consulting LLP.